how are property taxes calculated in martin county florida

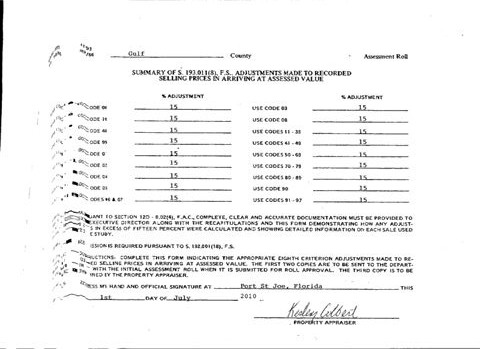

Find the assessed value of the property being taxed. To report an ADA accessibility issue request accessibility.

Florida Dept Of Revenue Property Tax Data Portal

Renew your vehicle registration at a self-service kiosk.

. The office of the Property Appraiser establishes the value of the property and the Board of County Commissioners School. Martin County is committed to ensuring website accessibility for people with disabilities. The kiosk will print your new registration and decal.

Web Property Information Lookup. Reasonable real estate worth growth will not boost your annual payment enough. The median property tax in Florida is 177300 per year for a home worth the median value of 18240000.

Web Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Apply for Business Tax account Run a. Were here to help you. When it comes to real estate property taxes are almost always.

Web To calculate the property tax use the following steps. Its fast and convenient. Web The tax year runs from January 1st to December 31st.

Web The average Florida homeowner pays 1752 each year in real property taxes although that amount varies between counties. For comparison the median home value in Martin. For example the property taxes on a home with a.

Web Thoroughly calculate your actual tax using any tax exemptions that you are allowed to utilize. Web To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address. Web To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

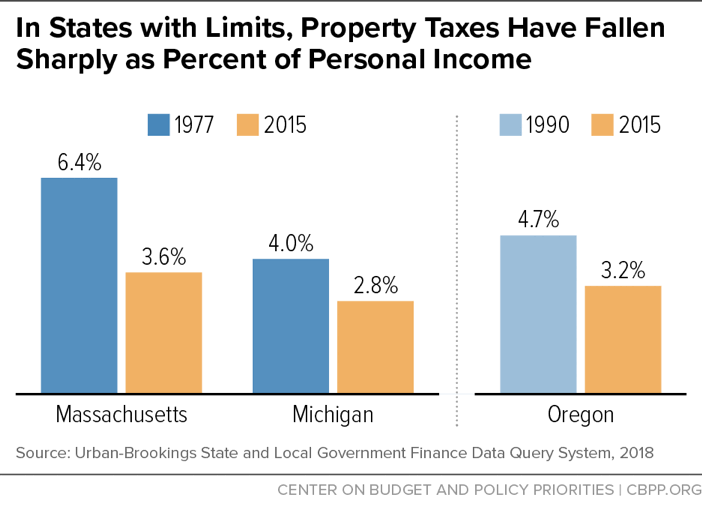

Florida real property tax rates are implemented in. Web The taxes due on a property are calculated by multiplying the adjusted taxable value of the property by the millage rate. 097 of home value.

Web The median property tax also known as real estate tax in Martin County is 231500 per year based on a median home value of 25490000 and a median effective property. Web Having trouble finding what youre looking for in our website. Web The service is available to all Florida residents.

Tax amount varies by county.

Palm Beach County Fl Property Tax Search And Records Propertyshark

Real Estate In Martin County Florida

Miami Dade County Fl Property Tax Search And Records Propertyshark

Florida Property Tax H R Block

Martin County Property Appraiser Property Tax Estimator

Florida Property Values Martin County Shows Record Breaking Numbers

Let S Talk Property Taxes 6 Things That Might Make Yours Increase Architectural Digest

Florida Dept Of Revenue Property Tax Data Portal

What Is The Florida Documentary Stamp Tax

Property Taxes Monroe County Tax Collector

Petition Lower St Lucie County S Highest In The State Of Florida Property Tax Millage Rate Change Org

Property Values Rising In St Lucie County Port St Lucie Sees 19 Spike

Property Tax Search Taxsys Martin County Tax Collector

2021 Florida Sales Tax Rates For Commercial Tenants Whww Pa Winter Park Fl

Voters Approve Special Tax To Support Martin County Schools

Santa Clara County Ca Property Tax Calculator Smartasset

Florida S 50 Largest Cities And Towns Ranked For Local Taxes Kiplinger

How Florida Property Tax Valuation Works Property Tax Adjustments Appeals P A